The year 2023 ended with a big rally in stocks. This has been one of my better years, my portfolio was up 19.10% this year and is now at a new ATH. I am a bit worried for 2024, recession should be looming around the corner. I am also a bit worried that such a large portion of my profits come from Nvidia. I will of course keep my holdings but I see they won't have such a stellar year next year, but who knows, maybe it will be another banger.

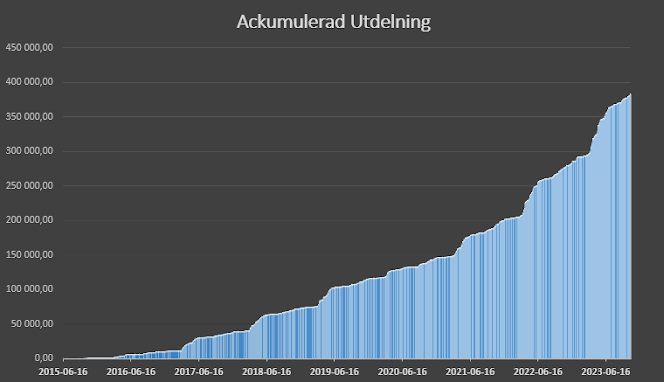

It has also been another record year for my dividends. At the beginning of last year I predicted that I would receive 100k in dividends. I managed to beat that and got roughly 107k. I beat the monthly records in ten out of twelve months and also beat the overall monthly record from last year. I had some lucky bonus dividends that will make it hard to beat the January record for a while. But with USD down to around SEK 10 I might be able to start buying US stocks again soon. Then I can start to boost some of the less dividend heavy months like January, February, July and August.

For next year my dividend goal will be to receive 125k in dividends. It's quite a high goal again, but with 6% dividend growth and 12k from new buys I believe it to be possible. There are some bonus dividends that will draw down the overall next year, like Volkswagen, Thomson Reuters and Yara. But hopefully there will be a few surprises in store for next year as well. One I have already seen, a small one but still, and that is that Disney will start to pay out dividend again, so that will give me a small boost to January and August. I also think companies like Firefly that have had such an amazing year will see a large increase in dividend growth next year, at least I hope so.

I received a total of SEK 4,433.83 in dividends in December. A decrease of 17.5% compared to last year, mostly due to Yara paying out a bonus dividend in December last year.

For the full year I received 182 dividends totalling SEK 107,253.72 an increase of 28.1% compared to 2022.

Reinvested dividends effect on yearly dividend: SEK 14.28 and for the whole of 2023 the reinvested dividend yearly effect is SEK 3,359.87. That is more than I received in dividends for the whole year when I started!

6 Lundin Mining shares: SEK 14.28

|

102,86 |

Intel |

|

258,01 |

Pfizer |

|

369,37 |

Johnson

& Johnson |

|

202,26 |

Unilever |

|

198,14 |

Autoliv |

|

535,89 |

Chevron |

|

265,79 |

3M |

|

530,75 |

Lundin

Mining |

|

380,24 |

Prudential

Financial |

|

293,33 |

Microsoft |

|

13,85 |

Wk Kellogg

Co |

|

221,58 |

Realty

Income |

|

332,46 |

McDonald's |

|

193,89 |

Kellogg |

|

246,86 |

Coca-Cola |

|

254,47 |

Thomson

Reuters |

|

34,08 |

Nvidia |